Charitable Gift Annuity

Looking for a way to diversify out of the fluctuating stock and real estate markets? A charitable gift annuity is a gift made to our organization that can provide you with a secure source of fixed payments for life.

Benefits of a charitable gift annuity

- Receive fixed payments to you or another annuitant you designate for life

- Receive a charitable income tax deduction for the charitable gift portion of the annuity

- Benefit from payments that may be partially tax free

- Further the charitable work of Phoenix Children's with your gift

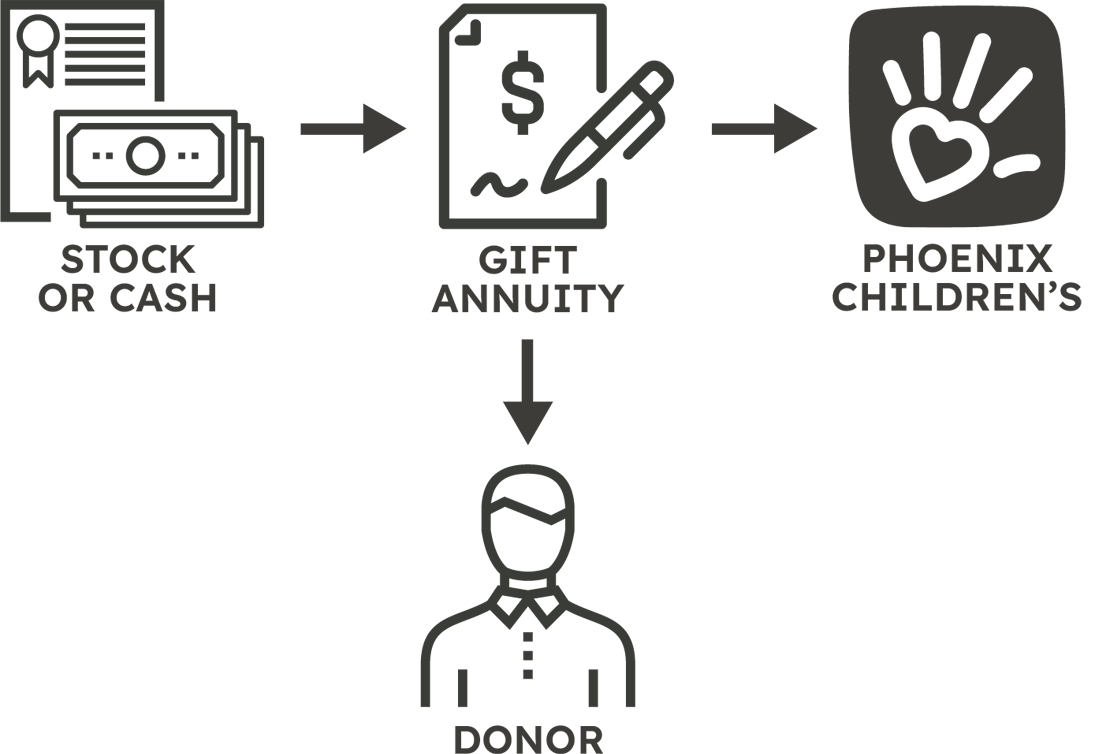

How a charitable gift annuity works

You have the opportunity to sustain world-class health care for the children of Arizona.

- You transfer cash or property to Phoenix Children's.

- In exchange, we sign an annuity contract and promise to pay fixed payments to you for life. The payment can be quite high depending on your age, and a portion of each payment may even be tax free.

- You will receive a charitable income tax deduction for the gift portion of the annuity.

- You have the opportunity to sustain world-class health care for the children of Arizona.

If you decide to fund your gift annuity with cash, a significant portion of the annuity payment will be tax free. You may also make a gift of appreciated securities to fund a gift annuity and avoid a portion of the capital gains tax. Please contact us to inquire about other assets that you might be able to use to fund a charitable gift annuity.

More on charitable gift annuities

Current charitable gift annuity (payments begin within one year). With a current gift annuity, you may transfer cash or property in exchange for our promise to pay you fixed payments beginning as early as this year. You will receive an income tax charitable deduction this year for the value of your gift to Phoenix Children's.

Deferred charitable gift annuity (for payments at future date). Perhaps you are not ready to begin receiving payments until a future date, such as when you retire. With a deferred gift annuity, you establish the gift annuity today and receive a charitable income tax deduction this year, but defer the payments until a designated date sometime in the future. Best of all, because you deferred the payments, your annual payment will be higher when the payments start than they would have been with a current gift annuity.

Flexible deferred charitable gift annuity (gives you flexibility as to when the payments will start). With a flexible deferred gift annuity, you retain the flexibility to decide when the annuity will begin making payments. As with a deferred gift annuity, you establish the annuity today and receive a charitable deduction this year, but the payments are deferred until such time as you elect to begin receiving the payments.

Contact us

If you have any questions about charitable gift annuities, please contact us. We would be happy to assist you and answer your questions.